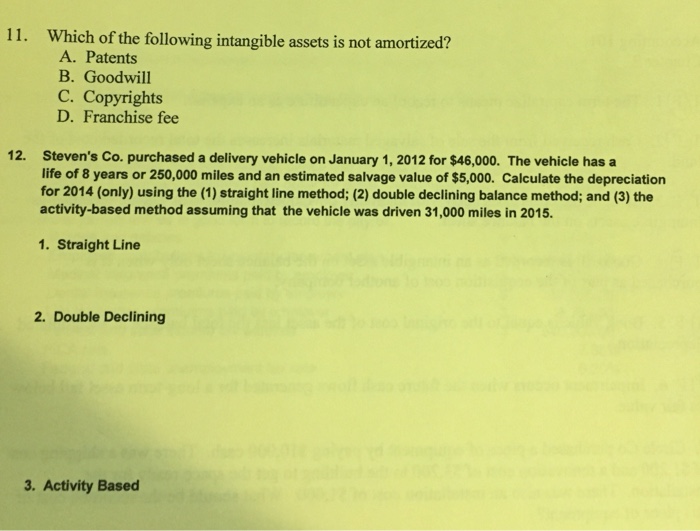

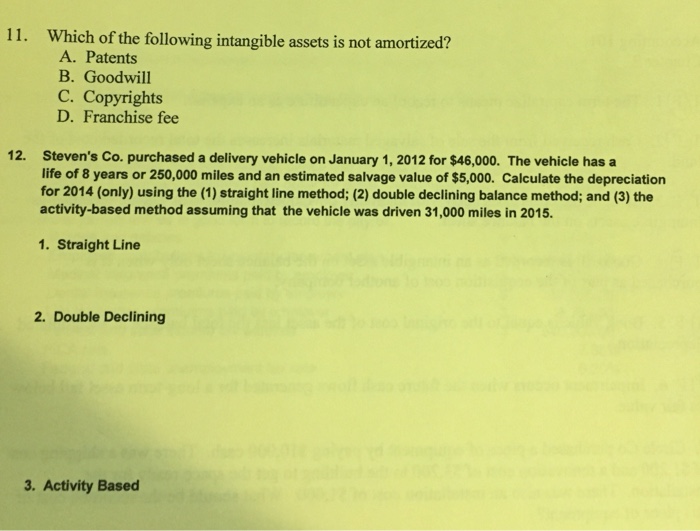

Which of the Following Intangible Assets Is Not Amortized

When intangible assets should not be amortized Most physical capital assets will depreciate over time. Intangible assets with a finite life must be written off amortized over the course of their useful life.

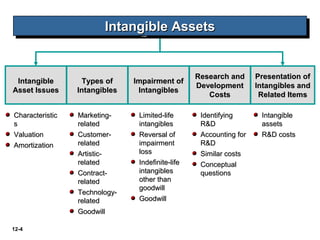

C H A P T E R 12 Intangible Assets Ppt Download

A group of assets that makes up a trade or business is exchanged for like-kind property in a transaction to which section 1031 applies.

. A The costs of organizing a corporation include legal fees fees paid to the state of incorporation fees paid to promoters and the costs of meetings for organizing the promoters. Land is one of the rare examples where a. Sale of a portion of a MACRS asset.

If section 1031 does not apply to all the assets transferred however Form 8594 is required for the part of the group of assets to which section 1031 does not apply. A good tip is if you plan on owning it for more than a year it should be considered a fixed asset. Involuntary conversion of a portion of a MACRS asset other than from a casualty or theft.

Form 8594 if any of the following apply. These are known as intangible assets and can be found under the intangible assets portion of the balance sheet. Capitalized as an intangible asset and amortized over a period not to exceed 20 years.

The impact of an upfront payment made by an acquiree to its customer is generally included by the acquirer as part of the valuation of the customer relationship intangible asset in acquisition accounting. Such deferred assets do not reflect separate assets to be recognized in acquisition accounting. Report the gain or loss if any on the following partial dispositions of MACRS assets on Form 4797 Part I II or III as applicable.

What Are Intangible Assets Double Entry Bookkeeping

Ch12 Accounting Intermediate Ind

Solved 11 Which Of The Following Intangible Assets Is Not Chegg Com

Comments

Post a Comment